MDA HOLDINGS LTD

|

ANNUAL REPORT 2017

33

Notes to the Consolidated

Financial Statements

(cont.)

For the year ended 30 September 2017

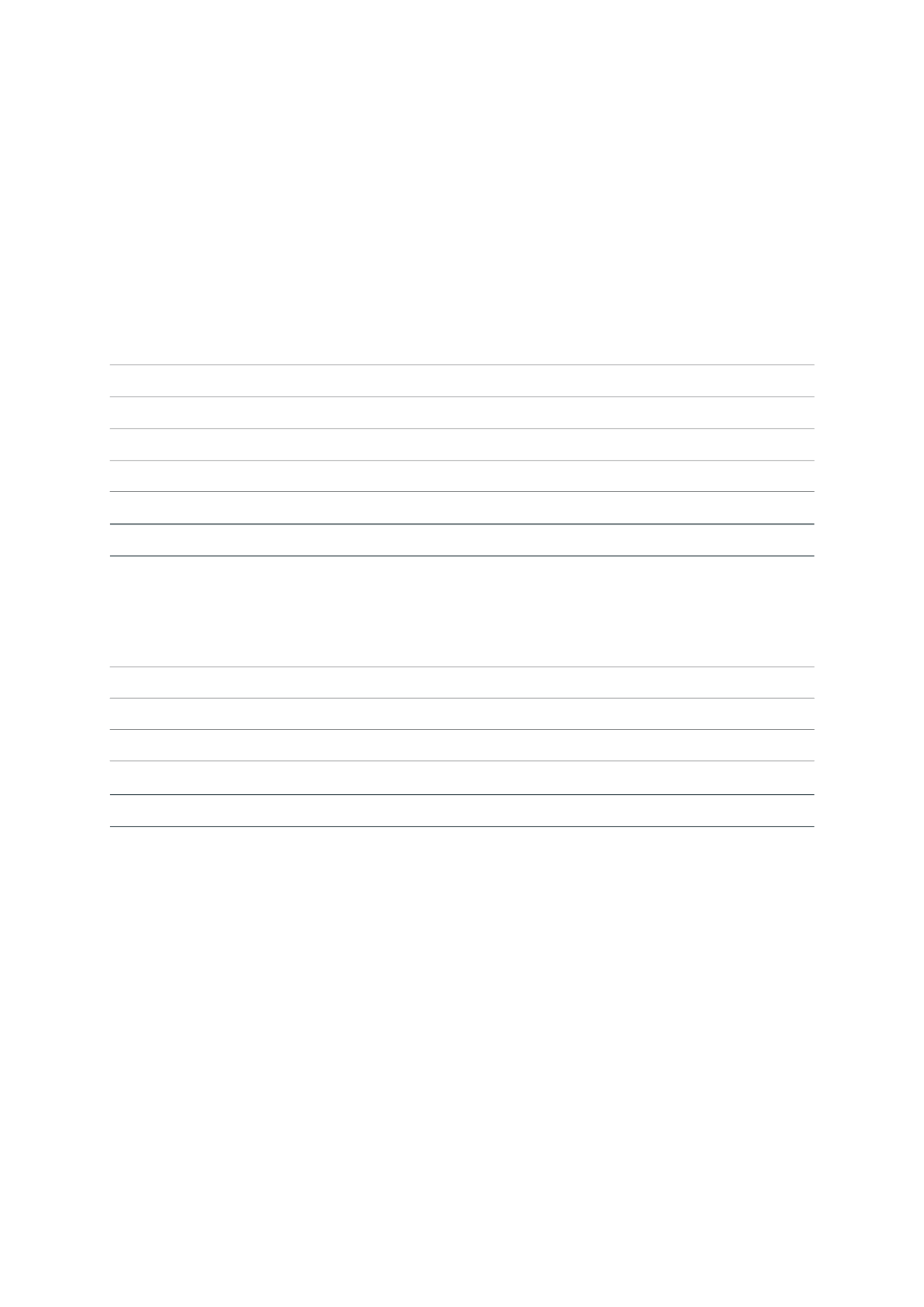

Retained

earnings

Share

premium

Share

premium

Retained

earnings

Capital

redemption

reserve

Capital

redemption

reserve

Totals

Totals

(£)

(£)

(£)

(£)

(£)

(£)

(£)

(£)

At 1 October 2016

901,470

408,378

1,494

1,311,342

Profit for the year

310,694

-

-

310,694

Dividends

(47,711)

-

-

(47,711)

Purchase of own shares

(206,968)

-

588

(206,380)

Exchange losses on consolidation

10,551

-

-

10,551

At 30 September 2017

968,036

408,378

2,082

1,378,496

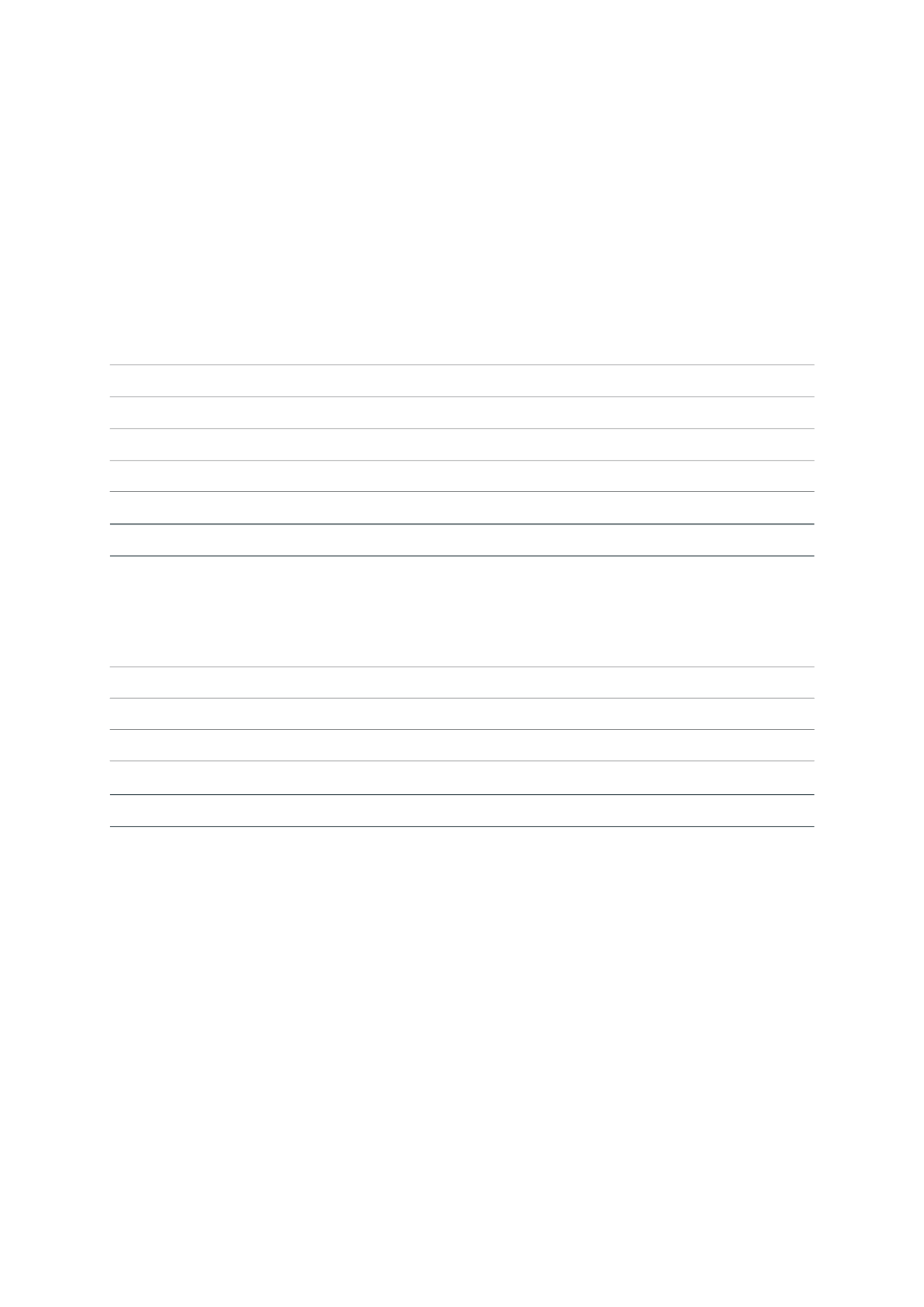

At 1 October 2016

1,746

408,378

1,494

411,618

Profit for the year

258,775

-

-

258,775

Dividends

(47,711)

-

-

(47,711)

Purchase of own shares

(206,968)

-

588

(206,380)

At 30 September 2017

5,842

408,378

2,082

416,302

Group

Company

15. Reserves

The company and certain other UK group companies have entered into cross guarantees in respect of a bank overdraft, which

has a group limit of £500,000 (2016: £500,000). This facility is held with HSBC Bank Plc and includes a fixed and floating charge

over all assets of the relevant companies.

During the previous year, a loan of £9,760 was made to R McGuinn, a director of the company. This balance was repaid in full

during the year.

This is the first period that the company has presented its financial statements in accordance with the provisions of Financial

Reporting Standard 102 Section 1A Small Entities (FRS 102 1A) issued by the Financial Reporting Council. The comparative

amounts have been restated accordingly. Therefore the date of transition is 1 October 2015. The last financial statements for the

company that were prepared in accordance with the previous accounting framework were for the period ended 30 September

2016.

There have been no adjustments arising upon transition to FRS 102 1A and as such there has been no impact on the company’s

financial position or financial performance on transition.

16. Guarantees and Other Financial Commitments

17. Directors Advances, Credits and Guarantees

18. Explanation of Transition to FRS 102 Section 1A